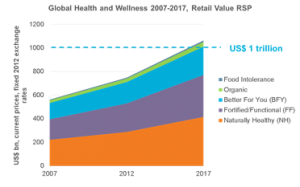

Healthy Vending – A Trillion Dollar Industry by 2017

The Healthy Vending industry is in demand and all around this beautiful country of ours people are making healthier snack and beverage choices. Healthier 4U Vending is seeking entrepreneurs from all over America to join us in our quest to promote health & wellness. There has never been a better time to start securing your financial future in the healthy vending industry and we’re here to help you every step of the way. From our top notch professional training services to our amazing machine placement, H4U is here to make sure you succeed!

Our revolutionary system was designed to function exactly like a franchise, without all the absurd franchise fees. As a H4U Vending business owner you’ll gain access to a huge untapped market. This market is one of the fastest growing markets in the world and we’re getting you in on the ground floor. The Health & Wellness industry is currently a $42 billion dollar industry and is growing fast.

Healthy Vending – the Trillion Dollar Industry in 2017: Key Research Highlights

Source: Euromonitor International

Analyst Insight by Ewa Hudson, Global Head of Health and Wellness Research at Euromonitor International

Strong recovery of the global health and wellness market is on the way, with sales recording 6.5% value growth (fixed exchange rates) in 2011. Products offering specific health benefits, such as fortified/functional, or those renowned for their natural health properties drove value sales, with rates above 7%. Growth was further fuelled by the developments in the emerging markets as China and Brazil alone contributed US$15 billion in new sales that year. Steady real term growth of 7.2% (current prices) is expected to continue to 2017, with global health and wellness sales on the way to hit a record high of US$1 trillion by 2017.

Health and Wellness Outperforms Wider Soft and Hot Drinks Industry

Health and wellness continued to drive growth and innovation in the wider food and beverage industries, with value sales at 19% of packaged food, and 43% of combined soft and hot drinks in 2011.

Health and Wellness Versus Non-Health and Wellness Packaged Food and Beverages, Retail Sales 2002-2017

Healthy convenience on the rise

Raising health awareness is more important than ever and continues to translate into substantial sales gains. Led by PepsiCo’s Gatorade, with sales up by US$956 million in 2011, over 40 brands in the Health and Wellness top 100 world ranking saw their sales rising by over US$100 million that year, a clear statement that combining four key factors: health, convenience, fashionable packaging and affordable price is the winning strategy behind some of the most spectacular health and wellness developments. These four factors played a key role in the success of products such as RTD green tea. Overtaking sales of traditional green tea, the ready to drink format spread from Asia all over the world, and the expected annual growth rate is 12% to 2017.

Despite numerous attempts to curb the growing obesity epidemic, the obese and overweight population is on the rise, crossing the 70% benchmark in Mexico, Venezuela, Australia and US (amongst the population aged 15+). Long-term solutions leading to calorie reduction via healthy lifestyle changes rather than short-term diets are becoming a necessity, hugely benefiting global sales of weight management positioned food and beverages, already at a staggering US$149 billion in 2011.

With fat reduction no longer sufficient on its own, the growing fashion for natural and less conventional slimming solutions has seen companies innovate further, this time with natural high intensity sweetener: stevia. Stevia sweetened products are thriving in the US and since the authorisation of stevia in the EU in December 2011, numerous new products have hit the shelves, opening up the chase for the first global brand.

Innovation – the heart of health and wellness

Innovation and product reformulation are, in fact, the heart of health and wellness, with the challenge being to deliver healthier, and ideally naturally sourced, food and drink formats tasting just like the beloved fully sugarised and full fat non health and wellness “parents”. Coca-Cola Zero (Coca-Cola, The) is a good example of how to do it successfully. Following the original Coca-Cola recipe (unlike Diet Coke), the brand managed to overtake the growth of the flagship Diet Coke increasing its sales by US$565 million in 2011, that is US$160 million more than Diet Coke. Are stevia-sweetened Coca-Cola variants on the horizon or will the focus remain on Sprite?

Science continues, however, to outpace the regulators and legislative constraints prove hard for the health and wellness players. Restrictions continue to close down across the world and Europe has become one of the toughest regulatory environments. The new laws, especially the list of generic health claims legalised in May 2012, offer opportunities industry wide but have also finally closed the door on many long-used health claims.

Probiotics, without a single approved health claim in the EU, are amongst the most adversely affected, and Western Europe is expected to witness the second consecutive year of sales decline in 2012 for pro/pre biotic yoghurt after years of spectacular growth prior to 2008. Whilst this negative performance pulls the global performance of pro/pre biotic yoghurt down to 9%, other regions show no signs of weakness with double-digit growth rates in both 2011 and 2012. Even the recession-stricken US saw pro/prebiotic yoghurt sales up by 26% in 2011 and a further advance of 13% is expected in 2012.

Finally, the pinnacle of health and wellness – ‘nutrigenomics’ or personalised nutrition, in which food scientists seek to treat chronic health conditions such as cardiovascular disease, diabetes, obesity and Alzheimer’s disease with a diet – is a step closer, with the leaders including Nestlé, PepsiCo and Danone heavily investing in institutes of nutrition, research and development. Whilst the movement towards prevention grows, convergence of nutrition and ‘pharma’ is starting to attract attention of the big pharmaceutical players with substantial investments likely to follow.